The Poker Face of Wall Street

商品資訊

ISBN13:9780471770572

出版社:JOHN WILEY & SONS;INC.

作者:AARON BROWN

出版日:2006/03/06

裝訂/頁數:精裝/368頁

規格:24.1cm*16.5cm*3.2cm (高/寬/厚)

商品簡介

作者簡介

名人/編輯推薦

目次

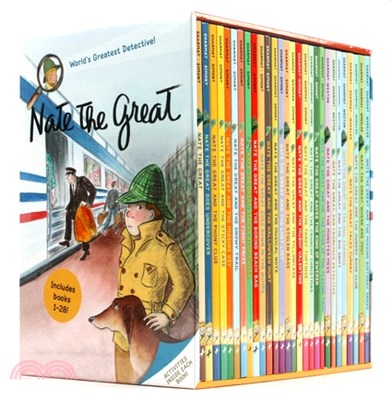

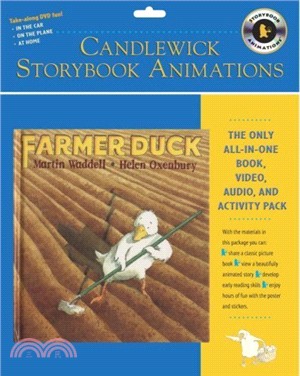

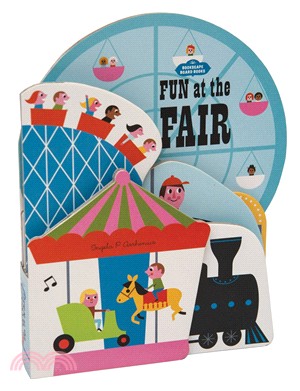

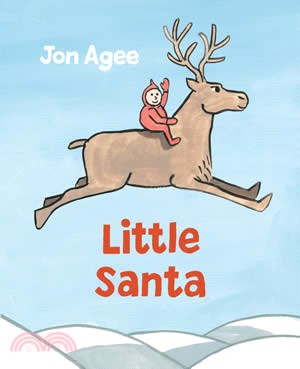

相關商品

商品簡介

Wall Street is where poker and modern finance and the theory behind these "games" clash head on. In both worlds, real risk means real money is made or lost in a heart beat, and neither camp is always rational with the risk it takes. As a result, business and financial professionals who want to use poker insights to improve their job performance will find this entertaining book a "must read." So will poker players searching for an edge in applying the insights of risk-takers on Wall Street.

作者簡介

AARON BROWN is an executive director at the investment bank Morgan Stanley. He won the Wilmott Award in 2005 as Financial Educator of the Year for his speaking, writing, and activism. He holds degrees in applied mathematics from Harvard (where he played poker with a future world's richest man and a future president of the United States) and finance from the University of Chicago (where he played poker with three Nobel Prize winners). A well-known Wall Street quant, he is a columnist for Wilmott, the leading journal serving the quantitative finance community. He has been involved in trading, risk management, and portfolio management for Prudential Insurance, JPMorgan, Rabobank, and Citigroup. He is also a serious lifelong poker player who has played with Wall Street tycoons and world champion poker pros.

名人/編輯推薦

Gamblers, be they poker players or stock traders, often talk in terms of limiting risk, turning a steady profit and keeping their heads down.

Not Aaron Brown, a Morgan Stanley executive director and card player who specializes in quantitative finance. He says the secret to winning is to embrace risk, not avoid it.

Gambling is more than a sucker's game in which the house wins even when it loses, he says in “The Poker Face of Wall Street.”

Gambling lies at the heart of economic institutions, he writes, and the reason is obvious: ``In order to win, you must take risk.''

Brown's book is both a how-to guide for poker players and an analysis of risk-management techniques he learned on trading floors at banks like Citigroup Inc. and JPMorgan Chase & Co. He convincingly argues that card strategies apply to investing, and he drives his thesis home with real-life examples.

Whether on the Street or on the Strip, Brown steers a course through the choppiest waters in hopes of netting the biggest rewards. Playing it safe is fine for the meek middle classes; he's writing for nonconformists with outsize egos.

Random Walk

“I've never met a successful poker player or trader who didn't believe he or she was better than everyone else,'' Brown writes. If you have that kind of faith in yourself,” it's impossible to settle for what everyone else has, however comfortable that is in absolute terms.'' Besides, he says, risk motivates and creates opportunities for the best people.

Brown couples such arguments with a knack for explaining mind-boggling concepts in a style that's part Ernest Hemingway, part Burton Malkiel, the Princeton University professor who wrote ``A Random Walk Down Wall Street,'' the bible of believers in the efficient-market hypothesis. The result is an engrossing look at why humans take risk -- and why those who avoid it at all costs tend to lose, both at poker and in life.

Malkiel's 1973 classic suggests that chance plays a deciding role in financial markets and that a blindfolded monkey can pick stocks as successfully as most portfolio managers do. Many investors have concluded from this that the only sensible course is to plow their money into index funds.

Don't Despair

Brown has no real beef with indexers; he's just convinced you can beat the average, even shoot for the moon, by taking on more risk. He juxtaposes, for example, the more than $1 billion George Soros won by betting against the British pound in 1992 with a card player who learns from past hands what an opponent is apt to do next. Past behavior can predict future actions.

You may end up in tight spots, Brown concedes. “The only assets you can count on after a loss are the ones inside you: your character, your talents, and your will,” he says.

What about gamblers whose wagers go massively awry, as they did at Long-Term Capital Management LP? That mess resulted from poor risk management, Brown says.

Far from being a frivolous pastime, poker helped build the U.S., Brown argues. As Americans pushed West in the 19th century, poker games allocated scarce resources in frontier towns, leaving winners with enough cash to start businesses in places that lacked banks.

Gates, Kerkorian

That tradition lived on through the 20th century as billionaires-to-be Bill Gates, H.L. Hunt, John Kluge and Carl Icahn got their first stakes in poker games. Kirk Kerkorian funded his first company, Los Angeles Air Service, with poker winnings. Hunt bet everything he had in a poker game and won his first oil well. Capital flowed from the luck of the draw and the skill of the bluffer.

Bluffing is misunderstood by most players, Brown writes. You should bluff only with your weakest hands, which are bound to lose anyway, he says. If you make a habit of this, your opponents will think you're bluffing when you have four aces. They'll stay in the game and get creamed.

Brown backs up these tips with examples culled from his own bets on futures desks: “When you do trade, it lights you up; you know you are alive. You're plugged into a network that lifts you up to the sky or plunges you down to the depths. You never want the market to close.”

This, he says, is like the thrill a poker player knows when he fills a royal flush -- or the agony he feels when an opponent draws out a higher straight. (Bloomberg News, April 27, 2006)

If you're looking for tips on becoming a better poker player, you've probably come to the wrong place. Brown does cover the game's basics and shares plenty of stories from his early card-playing days, which include Harvard games with the likes of Scott Turow. But he has much bigger stakes to discuss in this upbeat and entertaining guide. Drawing on his background at Morgan Stanley (where he's an executive director) and other financial institutions, Brown proposes that "finance can only be understood as a gambling game" and vice versa—and though the material can be rough going for those without some investment training, he's very convincing once all the cards are laid out. In an extended historical example, Brown shows how the economy of colonial America was jump-started by the introduction of faro dealers into French Louisiana. He sees the current financial market as filled with similar wealth-generating potential and believes "taking risks just makes sense" in such an opportunity-rich climate. Poker, then, becomes a tool for learning how to evaluate and embrace financial risk. Brown's model is instantly graspable, but so contrary to the conventional wisdom on both economics and gambling that it may well spark debate. (Apr.) (Publishers Weekly, March 6, 2006)

"A new book by Aaron Brown, Morgan Stanley's quantitative expert, aims to have investors (and poker players) apply the connections [between their crafts] for profit.... While the book may be the first attempt to help individual investors profit from a better understanding of the art of gambling, behavioural finance professors have employed gambling and investing decisions to explore how individuals behave when it comes to financial decisions....

While the professionals may understand this, most individual investors have not embraced the notion - something Mr Brown aims to rectify with his book. There may be few individuals better suited to take on such a controversial argument. The Harvard and University of Chicago-trained quantitative strategist has helped top-tier Wall Street firms manage uncertain risks for more than two decades. Mr Brown is also a life-long poker player who has shared the table with Wall Street bigwigs, Nobel Prize-winning researchers and world champion poker players.

In exploring the intrinsic links between gambling and investing, Mr Brown mines a rich vein of economic history and draws conclusions that may surprise. He demonstrates how gambling was at the centre of economic development in many river-network societies - explaining how the highly leveraged "soft banks" in the American frontier are much like modern poker houses and why it is no coincidence that futures markets and poker were invented in the same time and place, the American west of the 19th century.

More important than his historical research, however, are his explanations of the inner workings of poker hands and trading. Many casual players may feel poker is about intuition and trying to get a gut feeling from the player across the table. But Mr Brown's book leaves the impression that poker might be considered a type of quantitative investing where rapid processing of statistical probabilities can greatly enhance one's long-term returns. He also shows that while hand to hand and trade to trade markets may be random, the cumulative effect of previous trades (or hands) weighs heavily on future outcomes....

Similarly, Mr Brown provides many examples of how investing involves a careful application of uncalculated risks. These include George Soros' massively successful bet that the British pound was worth less than the amount the central bank was aiming to set against the D-Mark. He also offers more analysis of how to make money from the spreads in various dated options.

The bigger impact of Mr Brown's book is to get investors to rethink how they view placing bets with their money. Our understanding of the markets may be moving further away from the comforting notion of efficiency and steady returns and more toward an acceptance of uncertainty and incalculable risks.

Investors who recognise this will hold the stronger hand."—Steve Schurr (Financial Times, March 2006)

"[Brown] convincingly argues that card strategies apply to investing, and he drives his thesis home with real-life examples." (Bloomberg.com, May 2006)

"The personal stories are one of the most delightfully suprising aspects of the book. Despite the quantiative subject matter, it is exciting and easy to read. The book clearly illustrates that poker and finance are as much about people as they are about formulas and statistics." -- Michael B. Miller (GARP Risk Review, May/June 2006)

"The Poker Face of Wall Street is a sprawling, idiosyncratic, and sometimes poker-obsessed book filled with nuggets about American history and finance, from poker in gold-mining camps to the deeds of picaresque Scottish adventurer John Law, who used card games to grease the wheels of commerce in France's Louisiana Territory. ... Long hours at the poker table have given Brown a unique, not to say jaded, perspective on the hallowed institutions of modern finance." (BusinessWeek, June 2006)

"…if you fancy yourself as a trader...then this book is an excellent place to start." (Financial World, July 2006)

"Playing high-level poker, trading options, marketing bonds, and being a professor of finance-Aaron Brown has done them all. He shares with us the insights each of these has given him about the others and the lessons he's learned about life. From John Law to Fischer Black, I enjoyed the characters and the anecdotes."

—Edward O. Thorp, author of Beat the Dealer: A Winning Strategy for the Game of Twenty-One and Beat the Market: A Scientific Stock Market System

"How to be a poker pro and much more . . . a delightful journey through risk concepts with a Wall Street derivatives trader. Brown uses poker concepts as a wonderful metaphor for investment and living life. His enthusiasm for grasping the brass ring of adventure while explaining the role of 'incalculable risk' draws one into the experience of the book. A great read and a good manual for understanding risk."

—Dr. William T. Ziemba, Alumni Professor of Financial Modeling and Stochastic Optimization Emeritus), Sauder School of Business, University of British Columbia, Vancouver

"Make no mistake, this is a book about economic development as much as poker, and it tells how to win at both gambling games. Experienced poker players and economists will both look at the world with new eyes after hearing what Aaron Brown has to say."

—Perry Mehrling, Professor of Economics at Barnard College of Columbia University author of Fischer Black and the Revolutionary Idea of Finance

"The Poker Face of Wall Street is packed with useful information about gambling, the life on Wall Street, poker culture, and some of the most interesting people involved in gambling. The book is a great mix of entertaining and nontraditional thinking."

—Espen Gaarder Haug, Trader, JPMorgan author of The Complete Guide to Option Pricing Formulas

"The writer's experience and knowledge of the worlds of poker and finance come together in this intriguing and readable book.”

—Philip Augar, author of The Greed Merchants: How the Investment Banks Played the Free Market Game

“Aaron Brown brings together more colorful threads than a Persian carpet, more dimensions than an episode of Stargate and more interesting characters than Damon Runyan. Aaron Brown is the Damon Runyon for a technological age in which you need psychology, game theory and mathematics in place of the suit, the spats and the diamond stick pin.”

—Paul Wilmott, author and mathematician

"Overall, this book makes for excellent reading, and I would recommend it to anybody with an interest in the worlds of finance, poker or both. The author has an excellent style, and with chapter headings as diverse as 'The stormy, husky, brawling laughter of youth,' 'Frank’s grandma' and 'God gave you guts: don’t let him down,' you can feel the character and wit of the author jumping out onto the page. ... I recommend buying your copy now, and if you should happen across a small-stakes poker game on holiday, a few of the thoughts within the book should at least help you understand why you lost after the event!"-- Richard Norgate (Financial Engineering News, July/August 2006)

Not Aaron Brown, a Morgan Stanley executive director and card player who specializes in quantitative finance. He says the secret to winning is to embrace risk, not avoid it.

Gambling is more than a sucker's game in which the house wins even when it loses, he says in “The Poker Face of Wall Street.”

Gambling lies at the heart of economic institutions, he writes, and the reason is obvious: ``In order to win, you must take risk.''

Brown's book is both a how-to guide for poker players and an analysis of risk-management techniques he learned on trading floors at banks like Citigroup Inc. and JPMorgan Chase & Co. He convincingly argues that card strategies apply to investing, and he drives his thesis home with real-life examples.

Whether on the Street or on the Strip, Brown steers a course through the choppiest waters in hopes of netting the biggest rewards. Playing it safe is fine for the meek middle classes; he's writing for nonconformists with outsize egos.

Random Walk

“I've never met a successful poker player or trader who didn't believe he or she was better than everyone else,'' Brown writes. If you have that kind of faith in yourself,” it's impossible to settle for what everyone else has, however comfortable that is in absolute terms.'' Besides, he says, risk motivates and creates opportunities for the best people.

Brown couples such arguments with a knack for explaining mind-boggling concepts in a style that's part Ernest Hemingway, part Burton Malkiel, the Princeton University professor who wrote ``A Random Walk Down Wall Street,'' the bible of believers in the efficient-market hypothesis. The result is an engrossing look at why humans take risk -- and why those who avoid it at all costs tend to lose, both at poker and in life.

Malkiel's 1973 classic suggests that chance plays a deciding role in financial markets and that a blindfolded monkey can pick stocks as successfully as most portfolio managers do. Many investors have concluded from this that the only sensible course is to plow their money into index funds.

Don't Despair

Brown has no real beef with indexers; he's just convinced you can beat the average, even shoot for the moon, by taking on more risk. He juxtaposes, for example, the more than $1 billion George Soros won by betting against the British pound in 1992 with a card player who learns from past hands what an opponent is apt to do next. Past behavior can predict future actions.

You may end up in tight spots, Brown concedes. “The only assets you can count on after a loss are the ones inside you: your character, your talents, and your will,” he says.

What about gamblers whose wagers go massively awry, as they did at Long-Term Capital Management LP? That mess resulted from poor risk management, Brown says.

Far from being a frivolous pastime, poker helped build the U.S., Brown argues. As Americans pushed West in the 19th century, poker games allocated scarce resources in frontier towns, leaving winners with enough cash to start businesses in places that lacked banks.

Gates, Kerkorian

That tradition lived on through the 20th century as billionaires-to-be Bill Gates, H.L. Hunt, John Kluge and Carl Icahn got their first stakes in poker games. Kirk Kerkorian funded his first company, Los Angeles Air Service, with poker winnings. Hunt bet everything he had in a poker game and won his first oil well. Capital flowed from the luck of the draw and the skill of the bluffer.

Bluffing is misunderstood by most players, Brown writes. You should bluff only with your weakest hands, which are bound to lose anyway, he says. If you make a habit of this, your opponents will think you're bluffing when you have four aces. They'll stay in the game and get creamed.

Brown backs up these tips with examples culled from his own bets on futures desks: “When you do trade, it lights you up; you know you are alive. You're plugged into a network that lifts you up to the sky or plunges you down to the depths. You never want the market to close.”

This, he says, is like the thrill a poker player knows when he fills a royal flush -- or the agony he feels when an opponent draws out a higher straight. (Bloomberg News, April 27, 2006)

If you're looking for tips on becoming a better poker player, you've probably come to the wrong place. Brown does cover the game's basics and shares plenty of stories from his early card-playing days, which include Harvard games with the likes of Scott Turow. But he has much bigger stakes to discuss in this upbeat and entertaining guide. Drawing on his background at Morgan Stanley (where he's an executive director) and other financial institutions, Brown proposes that "finance can only be understood as a gambling game" and vice versa—and though the material can be rough going for those without some investment training, he's very convincing once all the cards are laid out. In an extended historical example, Brown shows how the economy of colonial America was jump-started by the introduction of faro dealers into French Louisiana. He sees the current financial market as filled with similar wealth-generating potential and believes "taking risks just makes sense" in such an opportunity-rich climate. Poker, then, becomes a tool for learning how to evaluate and embrace financial risk. Brown's model is instantly graspable, but so contrary to the conventional wisdom on both economics and gambling that it may well spark debate. (Apr.) (Publishers Weekly, March 6, 2006)

"A new book by Aaron Brown, Morgan Stanley's quantitative expert, aims to have investors (and poker players) apply the connections [between their crafts] for profit.... While the book may be the first attempt to help individual investors profit from a better understanding of the art of gambling, behavioural finance professors have employed gambling and investing decisions to explore how individuals behave when it comes to financial decisions....

While the professionals may understand this, most individual investors have not embraced the notion - something Mr Brown aims to rectify with his book. There may be few individuals better suited to take on such a controversial argument. The Harvard and University of Chicago-trained quantitative strategist has helped top-tier Wall Street firms manage uncertain risks for more than two decades. Mr Brown is also a life-long poker player who has shared the table with Wall Street bigwigs, Nobel Prize-winning researchers and world champion poker players.

In exploring the intrinsic links between gambling and investing, Mr Brown mines a rich vein of economic history and draws conclusions that may surprise. He demonstrates how gambling was at the centre of economic development in many river-network societies - explaining how the highly leveraged "soft banks" in the American frontier are much like modern poker houses and why it is no coincidence that futures markets and poker were invented in the same time and place, the American west of the 19th century.

More important than his historical research, however, are his explanations of the inner workings of poker hands and trading. Many casual players may feel poker is about intuition and trying to get a gut feeling from the player across the table. But Mr Brown's book leaves the impression that poker might be considered a type of quantitative investing where rapid processing of statistical probabilities can greatly enhance one's long-term returns. He also shows that while hand to hand and trade to trade markets may be random, the cumulative effect of previous trades (or hands) weighs heavily on future outcomes....

Similarly, Mr Brown provides many examples of how investing involves a careful application of uncalculated risks. These include George Soros' massively successful bet that the British pound was worth less than the amount the central bank was aiming to set against the D-Mark. He also offers more analysis of how to make money from the spreads in various dated options.

The bigger impact of Mr Brown's book is to get investors to rethink how they view placing bets with their money. Our understanding of the markets may be moving further away from the comforting notion of efficiency and steady returns and more toward an acceptance of uncertainty and incalculable risks.

Investors who recognise this will hold the stronger hand."—Steve Schurr (Financial Times, March 2006)

"[Brown] convincingly argues that card strategies apply to investing, and he drives his thesis home with real-life examples." (Bloomberg.com, May 2006)

"The personal stories are one of the most delightfully suprising aspects of the book. Despite the quantiative subject matter, it is exciting and easy to read. The book clearly illustrates that poker and finance are as much about people as they are about formulas and statistics." -- Michael B. Miller (GARP Risk Review, May/June 2006)

"The Poker Face of Wall Street is a sprawling, idiosyncratic, and sometimes poker-obsessed book filled with nuggets about American history and finance, from poker in gold-mining camps to the deeds of picaresque Scottish adventurer John Law, who used card games to grease the wheels of commerce in France's Louisiana Territory. ... Long hours at the poker table have given Brown a unique, not to say jaded, perspective on the hallowed institutions of modern finance." (BusinessWeek, June 2006)

"…if you fancy yourself as a trader...then this book is an excellent place to start." (Financial World, July 2006)

"Playing high-level poker, trading options, marketing bonds, and being a professor of finance-Aaron Brown has done them all. He shares with us the insights each of these has given him about the others and the lessons he's learned about life. From John Law to Fischer Black, I enjoyed the characters and the anecdotes."

—Edward O. Thorp, author of Beat the Dealer: A Winning Strategy for the Game of Twenty-One and Beat the Market: A Scientific Stock Market System

"How to be a poker pro and much more . . . a delightful journey through risk concepts with a Wall Street derivatives trader. Brown uses poker concepts as a wonderful metaphor for investment and living life. His enthusiasm for grasping the brass ring of adventure while explaining the role of 'incalculable risk' draws one into the experience of the book. A great read and a good manual for understanding risk."

—Dr. William T. Ziemba, Alumni Professor of Financial Modeling and Stochastic Optimization Emeritus), Sauder School of Business, University of British Columbia, Vancouver

"Make no mistake, this is a book about economic development as much as poker, and it tells how to win at both gambling games. Experienced poker players and economists will both look at the world with new eyes after hearing what Aaron Brown has to say."

—Perry Mehrling, Professor of Economics at Barnard College of Columbia University author of Fischer Black and the Revolutionary Idea of Finance

"The Poker Face of Wall Street is packed with useful information about gambling, the life on Wall Street, poker culture, and some of the most interesting people involved in gambling. The book is a great mix of entertaining and nontraditional thinking."

—Espen Gaarder Haug, Trader, JPMorgan author of The Complete Guide to Option Pricing Formulas

"The writer's experience and knowledge of the worlds of poker and finance come together in this intriguing and readable book.”

—Philip Augar, author of The Greed Merchants: How the Investment Banks Played the Free Market Game

“Aaron Brown brings together more colorful threads than a Persian carpet, more dimensions than an episode of Stargate and more interesting characters than Damon Runyan. Aaron Brown is the Damon Runyon for a technological age in which you need psychology, game theory and mathematics in place of the suit, the spats and the diamond stick pin.”

—Paul Wilmott, author and mathematician

"Overall, this book makes for excellent reading, and I would recommend it to anybody with an interest in the worlds of finance, poker or both. The author has an excellent style, and with chapter headings as diverse as 'The stormy, husky, brawling laughter of youth,' 'Frank’s grandma' and 'God gave you guts: don’t let him down,' you can feel the character and wit of the author jumping out onto the page. ... I recommend buying your copy now, and if you should happen across a small-stakes poker game on holiday, a few of the thoughts within the book should at least help you understand why you lost after the event!"-- Richard Norgate (Financial Engineering News, July/August 2006)

目次

Foreword.

Preface.

Chapter 1. The Art of Uncalculated Risk.

Chapter 2. Poker Basics.

Chapter 3. Finance Basics.

Chapter 4. A Brief History of Risk Denial.

Chapter 5. Pokernomics.

Chapter 6. Son of a Soft Money Bank.

Chapter 7. The once-bold mates of Morgan.

Chapter 8. The Games People Play.

Chapter 9. Who Got Game.

Chapter 10. Utility Belt.

Annotated Bibliography.

Index.

Preface.

Chapter 1. The Art of Uncalculated Risk.

Chapter 2. Poker Basics.

Chapter 3. Finance Basics.

Chapter 4. A Brief History of Risk Denial.

Chapter 5. Pokernomics.

Chapter 6. Son of a Soft Money Bank.

Chapter 7. The once-bold mates of Morgan.

Chapter 8. The Games People Play.

Chapter 9. Who Got Game.

Chapter 10. Utility Belt.

Annotated Bibliography.

Index.

主題書展

更多

主題書展

更多書展今日66折

您曾經瀏覽過的商品

購物須知

外文書商品之書封,為出版社提供之樣本。實際出貨商品,以出版社所提供之現有版本為主。部份書籍,因出版社供應狀況特殊,匯率將依實際狀況做調整。

無庫存之商品,在您完成訂單程序之後,將以空運的方式為你下單調貨。為了縮短等待的時間,建議您將外文書與其他商品分開下單,以獲得最快的取貨速度,平均調貨時間為1~2個月。

為了保護您的權益,「三民網路書店」提供會員七日商品鑑賞期(收到商品為起始日)。

若要辦理退貨,請在商品鑑賞期內寄回,且商品必須是全新狀態與完整包裝(商品、附件、發票、隨貨贈品等)否則恕不接受退貨。