Encyclopedia Of Candlestick Charts

商品資訊

系列名:Wiley Trading

ISBN13:9780470182017

出版社:John Wiley & Sons Inc

作者:Bulkowski

出版日:2008/02/26

裝訂/頁數:精裝/960頁

規格:26.0cm*19.1cm*4.4cm (高/寬/厚)

定價

:NT$ 6308 元優惠價

:90 折 5677 元

若需訂購本書,請電洽客服 02-25006600[分機130、131]。

商品簡介

作者簡介

名人/編輯推薦

目次

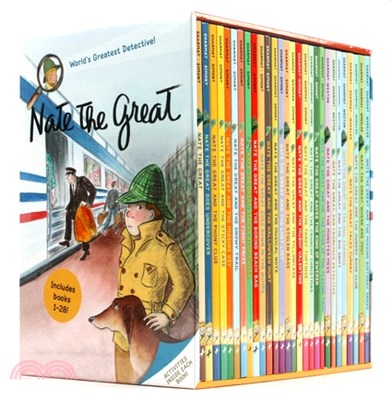

相關商品

商品簡介

Following in the footsteps of author Thomas Bulkowski’s bestselling Encyclopedia of Chart Patterns—and structured in the same way—this easy-to-read and -use resource takes an in-depth look at 103 candlestick formations, from identification guidelines and statistical analysis of their behavior to detailed trading tactics. Encyclopedia of Candlestick Charts also includes chapters that contain important discoveries and statistical summaries, as well as a glossary of relevant terms and a visual index to make candlestick identification easy.

作者簡介

Thomas N. Bulkowski is a successful investor with over twenty-five years of experience trading stocks. He is also the author of the Wiley titles Getting Started in Chart Patterns, Trading Classic Chart Patterns, and Encyclopedia of Chart Patterns, Second Edition. Bulkowski is a frequent contributor to Active Trader; Stocks, Futures & Options; Technical Analysis of Stocks & Commodities; and other publications. Before earning enough from his investments to "retire" from his day job at age thirty-six, Bulkowski was a hardware design engineer at Raytheon and a senior software engineer for Tandy Corporation.

名人/編輯推薦

"This book is a handy reference for beginners to advanced Technical Analysts. It contains statistical data for the performance of over 100 Candlestick patterns in both bull and bear markets, offers identification guidelines, and explores the performance of tall versus short candles and shadows. Of particular interest are the chapters which delve into important discoveries and those which explain each Table entry in detail and discuss the methodologies behind them. A useful addition it the visual index. Overall the easy to read makes this book a welcome addition to most Technical Analysis bookcases."

—IFTA Journal

—IFTA Journal

目次

Preface.

Acknowledgments.

Introduction.

1. Findings.

2. Statistics Summary.

3. 8 New Price Lines.

4. 10 New Price Lines.

5. 12 New Price Lines.

6. 13 New Price Lines.

7. Abandoned Baby, Bearish.

8. Abandoned Baby, Bullish.

9. Above The Stomach.

10. Advance Block.

11. Below The Stomach.

12. Belt Hold, Bearish.

13. Belt Hold, Bullish.

14. Breakaway, Bearish.

15. Breakaway, Bullish.

16. Candle, Black.

17. Candle, Short Black.

18. Candle, Short White.

19. Candle, White.

20. Concealing Baby Swallow.

21. Dark Cloud Cover.

22. Deliberation.

23. Doji, Dragonfly.

24. Doji, Gapping Down.

25. Doji, Gapping Up.

26. Doji, Gravestone.

27. Doji, Long Legged.

28. Doji, Northern.

29. Doji, Southern.

30. Doji Star, Bearish.

31. Doji Star, Bullish.

32.. Doji Star, Collapsing.

33. Downside Gap Three Methods.

34. Downside Tasuki Gap.

35. Engulfing, Bearish.

36. Engulfing, Bullish.

37. Evening Doji Star.

38 Evening Star.

39 Falling Three Methods.

40. Hammer.

41. Hammer, Inverted.

42. Hanging Man.

43. Harami, Bearish.

44. Harami, Bullish.

45. Harami Cross, Bearish.

46. Harami Cross, Bullish

47. High Wave.

48. Homing Pigeon.

49. Identical Three Crows.

50. In Neck.

51. Kicking, Bearish.

52. Kicking, Bullish.

53. Ladder Bottom.

54. Last Engulfing Bottom.

55. Last Engulfing Top.

56. Long Black Day.

57. Long White Day.

58. Marubozu, Black.

59. Marubozu, Closing Black.

60. Marubozu, Closing White.

61. Marubozu, Opening Black.

62. Marubozu, Opening White.

63. Marubozu, White.

64. Mat Hold.

65. Matching Low.

66. Meeting Lines, Bearish.

67. Meeting Lines, Bullish.

68. Morning Doji Star.

69. Morning Star.

70. On Neck.

71. Piercing Pattern.

72. Rickshaw Man.

73. Rising Three Methods.

74. Separating Lines, Bearish.

75. Separating Lines, Bullish.

76. Shooting Star, One-Candle.

77. Shooting Star, Two Candles.

78. Side-By-Side White Lines, Bearish.

79. Side-By-Side White Lines, Bullish.

80. Spinning Top, Black.

81. Spinning Top, White.

82. Stick Sandwich.

83. Takuri Lines.

84. Three Black Crows.

85. Three Inside Down.

86. Three Inside Up.

87. Three-Line Strike, Bearish.

88. Three-Line Strike, Bullish.

89. Three Outside Down.

90. Three Outside Up.

91. Three Stars In The South.

92. Three White Soldiers.

93. Thrusting.

94. Tri-Star, Bearish.

95. Tri-Star, Bullish.

96. Tweezers, Bottom.

97. Tweezers, Top.

98. Two Black Gapping Candles.

99. Two Crows.

100.Unique Three-River Bottom.

101. Upside Gap Three Methods.

102. Upside Gap Two Crows.

103. Upside Tasuki Gap.

104. Window, Falling.

105. Window, Rising.

Bibliography.

Glossary And Methodology.

Visual Index.

Subject Index.

Acknowledgments.

Introduction.

1. Findings.

2. Statistics Summary.

3. 8 New Price Lines.

4. 10 New Price Lines.

5. 12 New Price Lines.

6. 13 New Price Lines.

7. Abandoned Baby, Bearish.

8. Abandoned Baby, Bullish.

9. Above The Stomach.

10. Advance Block.

11. Below The Stomach.

12. Belt Hold, Bearish.

13. Belt Hold, Bullish.

14. Breakaway, Bearish.

15. Breakaway, Bullish.

16. Candle, Black.

17. Candle, Short Black.

18. Candle, Short White.

19. Candle, White.

20. Concealing Baby Swallow.

21. Dark Cloud Cover.

22. Deliberation.

23. Doji, Dragonfly.

24. Doji, Gapping Down.

25. Doji, Gapping Up.

26. Doji, Gravestone.

27. Doji, Long Legged.

28. Doji, Northern.

29. Doji, Southern.

30. Doji Star, Bearish.

31. Doji Star, Bullish.

32.. Doji Star, Collapsing.

33. Downside Gap Three Methods.

34. Downside Tasuki Gap.

35. Engulfing, Bearish.

36. Engulfing, Bullish.

37. Evening Doji Star.

38 Evening Star.

39 Falling Three Methods.

40. Hammer.

41. Hammer, Inverted.

42. Hanging Man.

43. Harami, Bearish.

44. Harami, Bullish.

45. Harami Cross, Bearish.

46. Harami Cross, Bullish

47. High Wave.

48. Homing Pigeon.

49. Identical Three Crows.

50. In Neck.

51. Kicking, Bearish.

52. Kicking, Bullish.

53. Ladder Bottom.

54. Last Engulfing Bottom.

55. Last Engulfing Top.

56. Long Black Day.

57. Long White Day.

58. Marubozu, Black.

59. Marubozu, Closing Black.

60. Marubozu, Closing White.

61. Marubozu, Opening Black.

62. Marubozu, Opening White.

63. Marubozu, White.

64. Mat Hold.

65. Matching Low.

66. Meeting Lines, Bearish.

67. Meeting Lines, Bullish.

68. Morning Doji Star.

69. Morning Star.

70. On Neck.

71. Piercing Pattern.

72. Rickshaw Man.

73. Rising Three Methods.

74. Separating Lines, Bearish.

75. Separating Lines, Bullish.

76. Shooting Star, One-Candle.

77. Shooting Star, Two Candles.

78. Side-By-Side White Lines, Bearish.

79. Side-By-Side White Lines, Bullish.

80. Spinning Top, Black.

81. Spinning Top, White.

82. Stick Sandwich.

83. Takuri Lines.

84. Three Black Crows.

85. Three Inside Down.

86. Three Inside Up.

87. Three-Line Strike, Bearish.

88. Three-Line Strike, Bullish.

89. Three Outside Down.

90. Three Outside Up.

91. Three Stars In The South.

92. Three White Soldiers.

93. Thrusting.

94. Tri-Star, Bearish.

95. Tri-Star, Bullish.

96. Tweezers, Bottom.

97. Tweezers, Top.

98. Two Black Gapping Candles.

99. Two Crows.

100.Unique Three-River Bottom.

101. Upside Gap Three Methods.

102. Upside Gap Two Crows.

103. Upside Tasuki Gap.

104. Window, Falling.

105. Window, Rising.

Bibliography.

Glossary And Methodology.

Visual Index.

Subject Index.

主題書展

更多

主題書展

更多書展今日66折

您曾經瀏覽過的商品

購物須知

外文書商品之書封,為出版社提供之樣本。實際出貨商品,以出版社所提供之現有版本為主。部份書籍,因出版社供應狀況特殊,匯率將依實際狀況做調整。

無庫存之商品,在您完成訂單程序之後,將以空運的方式為你下單調貨。為了縮短等待的時間,建議您將外文書與其他商品分開下單,以獲得最快的取貨速度,平均調貨時間為1~2個月。

為了保護您的權益,「三民網路書店」提供會員七日商品鑑賞期(收到商品為起始日)。

若要辦理退貨,請在商品鑑賞期內寄回,且商品必須是全新狀態與完整包裝(商品、附件、發票、隨貨贈品等)否則恕不接受退貨。