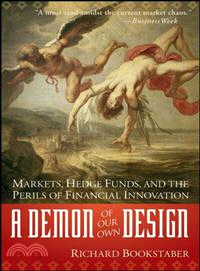

A Demon Of Our Own Design: Markets, Hedge Funds, And The Perils Of Financial Innovation

商品資訊

ISBN13:9780470393758

出版社:John Wiley & Sons Inc

作者:Bookstaber

出版日:2008/11/14

裝訂/頁數:平裝/304頁

規格:22.9cm*14.6cm*1.9cm (高/寬/厚)

商品簡介

作者簡介

目次

相關商品

商品簡介

Inside markets, innovation, and risk

Why do markets keep crashing and why are financial crises greater than ever before? As the risk manager to some of the leading firms on Wall Street–from Morgan Stanley to Salomon and Citigroup–and a member of some of the world’s largest hedge funds, from Moore Capital to Ziff Brothers and FrontPoint Partners, Rick Bookstaber has seen the ghost inside the machine and vividly shows us a world that is even riskier than we think. The very things done to make markets safer, have, in fact, created a world that is far more dangerous. From the 1987 crash to Citigroup closing the Salomon Arb unit, from staggering losses at UBS to the demise of Long-Term Capital Management, Bookstaber gives readers a front row seat to the management decisions made by some of the most powerful financial figures in the world that led to catastrophe, and describes the impact of his own activities on markets and market crashes. Much of the innovation of the last 30 years has wreaked havoc on the markets and cost trillions of dollars. A Demon of Our Own Design tells the story of man’s attempt to manage market risk and what it has wrought. In the process of showing what we have done, Bookstaber shines a light on what the future holds for a world where capital and power have moved from Wall Street institutions to elite and highly leveraged hedge funds.

Why do markets keep crashing and why are financial crises greater than ever before? As the risk manager to some of the leading firms on Wall Street–from Morgan Stanley to Salomon and Citigroup–and a member of some of the world’s largest hedge funds, from Moore Capital to Ziff Brothers and FrontPoint Partners, Rick Bookstaber has seen the ghost inside the machine and vividly shows us a world that is even riskier than we think. The very things done to make markets safer, have, in fact, created a world that is far more dangerous. From the 1987 crash to Citigroup closing the Salomon Arb unit, from staggering losses at UBS to the demise of Long-Term Capital Management, Bookstaber gives readers a front row seat to the management decisions made by some of the most powerful financial figures in the world that led to catastrophe, and describes the impact of his own activities on markets and market crashes. Much of the innovation of the last 30 years has wreaked havoc on the markets and cost trillions of dollars. A Demon of Our Own Design tells the story of man’s attempt to manage market risk and what it has wrought. In the process of showing what we have done, Bookstaber shines a light on what the future holds for a world where capital and power have moved from Wall Street institutions to elite and highly leveraged hedge funds.

作者簡介

Richard Bookstaber ran an equity hedge fund at FrontPoint Partners and was the director of risk management at Ziff Brothers Investments and at Moore Capital Management, one of the largest hedge funds in the world. He served as the managing director in charge of firm-wide risk management at Salomon Brothers and was a member of Salomon's powerful Risk Management Committee. Mr. Bookstaber also spent ten years at Morgan Stanley in quantitative research and as a proprietary trader, concluding his tenure there as Morgan Stanley's first market risk manager. He is the author of three books and scores of articles on finance topics ranging from options theory to risk management. Bookstaber received a PhD in economics from MIT. He now works at a hedge fund in Connecticut.

目次

Preface.

Acknowledgments.

About the Author.

CHAPTER 1 ~ Introduction: The Paradox of Market Risk.

CHAPTER 2 ~ The Demons of ’87.

CHAPTER 3 ~ A New Sheriff in Town.

CHAPTER 4 ~ How Salomon Rolled the Dice and Lost.

CHAPTER 5 ~ They Bought Salomon, Then They Killed It.

CHAPTER 6 ~ Long-Term Capital Management Rides the Leverage Cycle to Hell.

CHAPTER 7 ~ Colossus.

CHAPTER 8 ~ Complexity, Tight Coupling, and Normal Accidents.

CHAPTER 9 ~ The Brave New World of Hedge Funds.

CHAPTER 10 ~ Cockroaches and Hedge Funds.

CHAPTER 11 ~ Hedge Fund Existential.

Conclusion: Built to Crash?

Notes.

Index.

Acknowledgments.

About the Author.

CHAPTER 1 ~ Introduction: The Paradox of Market Risk.

CHAPTER 2 ~ The Demons of ’87.

CHAPTER 3 ~ A New Sheriff in Town.

CHAPTER 4 ~ How Salomon Rolled the Dice and Lost.

CHAPTER 5 ~ They Bought Salomon, Then They Killed It.

CHAPTER 6 ~ Long-Term Capital Management Rides the Leverage Cycle to Hell.

CHAPTER 7 ~ Colossus.

CHAPTER 8 ~ Complexity, Tight Coupling, and Normal Accidents.

CHAPTER 9 ~ The Brave New World of Hedge Funds.

CHAPTER 10 ~ Cockroaches and Hedge Funds.

CHAPTER 11 ~ Hedge Fund Existential.

Conclusion: Built to Crash?

Notes.

Index.

主題書展

更多

主題書展

更多書展今日66折

您曾經瀏覽過的商品

購物須知

外文書商品之書封,為出版社提供之樣本。實際出貨商品,以出版社所提供之現有版本為主。部份書籍,因出版社供應狀況特殊,匯率將依實際狀況做調整。

無庫存之商品,在您完成訂單程序之後,將以空運的方式為你下單調貨。為了縮短等待的時間,建議您將外文書與其他商品分開下單,以獲得最快的取貨速度,平均調貨時間為1~2個月。

為了保護您的權益,「三民網路書店」提供會員七日商品鑑賞期(收到商品為起始日)。

若要辦理退貨,請在商品鑑賞期內寄回,且商品必須是全新狀態與完整包裝(商品、附件、發票、隨貨贈品等)否則恕不接受退貨。