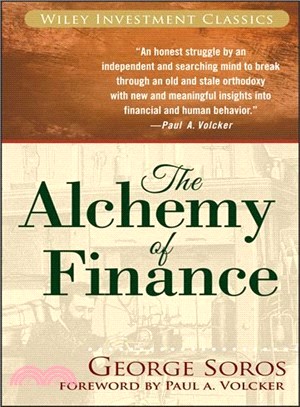

The Alchemy Of Finance 2E

商品資訊

系列名:Wiley Investment Classics

ISBN13:9780471445494

出版社:John Wiley & Sons Inc

作者:Soros

出版日:2003/07/15

裝訂/頁數:平裝/416頁

規格:22.9cm*15.2cm*3.2cm (高/寬/厚)

商品簡介

作者簡介

目次

相關商品

商品簡介

New chapter by Soros on the secrets to his success along with a new Preface and Introduction. New Foreword by renowned economist Paul Volcker "An extraordinary . . . inside look into the decision-making process of the most successful money manager of our time. Fantastic." -The Wall Street Journal George Soros is unquestionably one of the most powerful and profitable investors in the world today. Dubbed by BusinessWeek as "the Man who Moves Markets," Soros made a fortune competing with the British pound and remains active today in the global financial community. Now, in this special edition of the classic investment book, The Alchemy of Finance, Soros presents a theoretical and practical account of current financial trends and a new paradigm by which to understand the financial market today. This edition's expanded and revised Introduction details Soros's innovative investment practices along with his views of the world and world order. He also describes a new paradigm for the "theory of reflexivity" which underlies his unique investment strategies. Filled with expert advice and valuable business lessons, The Alchemy of Finance reveals the timeless principles of an investing legend. This special edition will feature a new chapter by Soros on the secrets of his success and a new Foreword by the Honorable Paul Volcker, former Chairman of the Federal Reserve. George Soros (New York, NY) is President of Soros Fund Management and Chief Investment Advisor to Quantum Fund N.V., a $12 billion international investment fund. Besides his numerous ventures in finance, Soros is also extremely active in the worlds of education, culture, and economic aid and development through his Open Society Fund and the Soros Foundation.

作者簡介

GEORGE SOROS is Chairman of Soros Fund Management, which serves as the principal investment advisor to the multibillion dollar Quantum Group of Funds. Soros's flagship Quantum Fund is recognized as the most successful investment fund ever, returning an average 31 percent annually for more than thirty years. Soros has been an important philanthropist since 1979. His charitable foundations are active in more than fifty countries and spend nearly half a billion dollars each year to support projects in education, public health, civil society development, human rights, and many other areas.

目次

Foreword to the New Edition by Paul A. Volcker.

Foreword to the First Edition by Paul Tudor Jones II.

New Preface.

New Introduction.

PART ONE: THEORY

1. Reflexivity in the Stock Market.

2. Reflexivity in the Currency Market.

3. The Credit and Regulatory Cycle.

PART TWO: HISTORICAL PERSPECTIVE.

4. The International Debt Problem.

5. The Collective System of Lending.

6. Reagan’s Imperial Circle.

7. Evolution of the Banking System.

8. The "Oligopolarization" of America.

PART THREE: THE REAL-TIME EXPERIMENT.

9. The Starting Point: August 1985.

10. Phase 1: August 1985-December 1985.

11. Control Period: January 186-July 1986.

12. Phase 2: July 1986-November 1986.

13. The Conclusion: November 1986.

PART FOUR: EVALUATION.

14. The Scope for Financial Alchemy: An Evaluation of the Experiment.

15. The Quandary of the Social Sciences.

PART FIVE: PRESCRIPTION.

16. Free Markets Versus Regulation.

17. Toward an International Central Bank.

18. The Paradox of Systemic Reform.

19. The Crash of '87.

Epilogue.

Notes.

Appendix.

Foreword to the First Edition by Paul Tudor Jones II.

New Preface.

New Introduction.

PART ONE: THEORY

1. Reflexivity in the Stock Market.

2. Reflexivity in the Currency Market.

3. The Credit and Regulatory Cycle.

PART TWO: HISTORICAL PERSPECTIVE.

4. The International Debt Problem.

5. The Collective System of Lending.

6. Reagan’s Imperial Circle.

7. Evolution of the Banking System.

8. The "Oligopolarization" of America.

PART THREE: THE REAL-TIME EXPERIMENT.

9. The Starting Point: August 1985.

10. Phase 1: August 1985-December 1985.

11. Control Period: January 186-July 1986.

12. Phase 2: July 1986-November 1986.

13. The Conclusion: November 1986.

PART FOUR: EVALUATION.

14. The Scope for Financial Alchemy: An Evaluation of the Experiment.

15. The Quandary of the Social Sciences.

PART FIVE: PRESCRIPTION.

16. Free Markets Versus Regulation.

17. Toward an International Central Bank.

18. The Paradox of Systemic Reform.

19. The Crash of '87.

Epilogue.

Notes.

Appendix.

主題書展

更多

主題書展

更多書展今日66折

您曾經瀏覽過的商品

購物須知

外文書商品之書封,為出版社提供之樣本。實際出貨商品,以出版社所提供之現有版本為主。部份書籍,因出版社供應狀況特殊,匯率將依實際狀況做調整。

無庫存之商品,在您完成訂單程序之後,將以空運的方式為你下單調貨。為了縮短等待的時間,建議您將外文書與其他商品分開下單,以獲得最快的取貨速度,平均調貨時間為1~2個月。

為了保護您的權益,「三民網路書店」提供會員七日商品鑑賞期(收到商品為起始日)。

若要辦理退貨,請在商品鑑賞期內寄回,且商品必須是全新狀態與完整包裝(商品、附件、發票、隨貨贈品等)否則恕不接受退貨。